VA Overpayment: What Happens When the VA Pays You Too Much

Table of Contents

- Understanding VA Benefits Overpayments: The Hidden Trap Thousands Face

- When the VA Discovers They’ve Overpaid You: Detection and Notification

- Your Options When Facing Overpayment Demands: Resolution Strategies That Work

- Beware of VA Overpayment Scams: Protecting Yourself from Fraud

- Preventing Future Overpayment Headaches: Smart Practices Every Veteran Should Know

- Final Thoughts

TL;DR

- VA benefits overpayments happen when veterans receive more compensation than legally entitled, affecting thousands annually through administrative errors, unreported life changes, or income threshold violations

- Veterans have specific legal rights including proper notice, response opportunities, and hearing procedures before the VA can collect any overpayment debt

- Waiver applications can eliminate repayment obligations when veterans prove they were “without fault” and that collection would cause financial hardship

- The VA must follow strict notification requirements, giving veterans 180 days to respond with appeals, waiver requests, or payment arrangements

- Proactive reporting of life changes and maintaining detailed records helps prevent overpayment situations before they start

- Be vigilant against overpayment scams—fraudsters impersonate VA officials to steal money and personal information

Understanding VA Benefits Overpayments: The Hidden Trap Thousands Face

That monthly VA check represents financial security for millions of veterans—until a notice arrives claiming the VA has been paying too much. The scale of this issue is significant: the VA issued at least $5.1 billion in compensation and pension overpayments from fiscal year 2021 to fiscal year 2024 according to the House Subcommittee on Disability Assistance and Memorial Affairs. VA benefits overpayment situations create legal debts that can seriously impact financial stability and future benefits.

When the VA determines that benefits exceeded what a veteran was entitled to receive, this creates a debt situation that requires careful navigation. These overpayments stem from various causes including processing errors, unreported life changes, and income violations, all governed by specific legal frameworks.

Why Overpayments Happen: The Most Common Culprits

Overpayments occur through multiple pathways, each requiring different approaches for resolution and prevention.

VA Processing Mistakes: When the System Fails Veterans

Administrative processing errors represent the most frequent overpayment cause. Claims processors may enter incorrect effective dates, miscalculate rating percentages, or apply outdated rating schedules. These errors occur during routine claims processing, yet veterans face debt notices demanding repayment for mistakes they didn’t make.

Recent oversight findings reveal the severity of processing errors: a statistical sample of PACT Act-related claims from August 2022 to August 2023 found about 25% were improperly calculated according to the VA inspector general.

Data entry errors happen more often than many realize. A 70% rating might get entered as 100%, or an effective date gets backdated incorrectly, creating months of overpayments. Veterans typically have no way of knowing the error occurred until notification arrives.

Rating schedule misapplications create particularly complex situations. When incorrect compensation tables are used or proper regional adjustments aren’t applied, overpayment amounts can be substantial—and completely beyond the veteran’s control.

Life Changes That Trigger Overpayment Traps

Dependency status changes including marriage, divorce, or children’s school enrollment modifications can create overpayments when changes aren’t promptly reported to the VA.

A daughter graduates college, but dependency allowance continues. A divorce occurs, yet spousal benefits continue for months. These situations create overpayments that occur when reporting requirements aren’t immediately met.

The impact of dependency-related overpayments is significant: of the nearly $1.4 billion overpaid in fiscal year 2021, about $913 million was related to dependent changes according to VA spokesperson Peter Kasperowicz.

Marriage changes affect many veterans. When new spousal income isn’t reported within the required timeframe, pension overpayments can reach thousands of dollars.

School enrollment changes catch many families unprepared. When children drop courses mid-semester or reduce their course load below full-time status, dependency payments may continue, creating unintended debt.

Consider veteran John Mullens from Bonaire, Georgia, who reported a dependent change in February after his 18-year-old son became eligible for separate VA educational benefits. Despite filing the removal request on February 18th, the VA continued overpaying him $340 monthly until May, when they finally acknowledged the duplicate payments and demanded repayment.

Income Limits: The Moving Target

Veterans receiving need-based benefits like pension may unknowingly exceed income limits, creating overpayment situations that require careful documentation and resolution strategies.

Pension benefits come with income restrictions that change annually. Small raises, Social Security increases, or other income changes can push recipients over limits, resulting in overpayment demands for benefits received in good faith.

Income reporting requirements aren’t always clear. One-time payments, inheritances, or even gifts can push veterans over pension income limits. The VA’s definition of “countable income” includes sources that might not seem relevant.

Income limits adjust each year, but these changes aren’t always communicated effectively. Veterans might stay within previous year’s limits while unknowingly exceeding current thresholds.

Your Legal Rights: What the VA Must Do

The legal framework governing overpayments establishes specific veteran rights including due process requirements and waiver eligibility standards.

Due Process: Constitutional Protections

Veterans possess constitutional and statutory rights to proper notice, response opportunities, and fair hearing procedures before any VA collection actions can begin.

Proper notice means more than just a letter stating a debt exists. The VA must explain exactly how the overpayment occurred, what time period it covers, and what evidence supports their determination. When notices lack these details, veterans have grounds to challenge the entire process.

The right to a hearing isn’t ceremonial. Veterans can present evidence, question VA witnesses, and have representation present. Many don’t realize they can demand an in-person hearing rather than accepting a paper review.

Waiver Rights: Paths to Debt Forgiveness

Federal law provides specific criteria allowing veterans to request overpayment debt forgiveness through “without fault” determinations and financial hardship demonstrations.

Veterans can request complete forgiveness of overpayment debts under specific circumstances. The VA doesn’t advertise this option prominently, but it’s a legal right.

“Without fault” determinations can eliminate entire debts. When veterans can prove they didn’t know (and reasonably shouldn’t have known) about the overpayment, they might owe nothing. This focuses on reasonable reliance on VA communications and actions.

Financial hardship waivers provide another path to debt elimination. Even without proving “without fault,” demonstrating that repayment would deprive families of basic necessities can result in complete debt forgiveness.

When the VA Discovers They’ve Overpaid You: Detection and Notification

The VA employs systematic detection methods including automated data matching and periodic reviews to identify overpayments, followed by specific notification procedures that must provide veterans with essential information about their rights and resolution options.

Understanding how the VA discovers overpayments and what they must communicate helps veterans respond strategically rather than reactively.

How the VA Finds Overpayments: The Detection Machine

Multiple automated and manual review processes help the VA identify potential overpayments, though system limitations and processing delays can complicate accurate detection and timely resolution.

Computer Systems That Monitor Continuously

Automated data matching systems cross-reference veteran records with federal databases to identify potential eligibility changes that might trigger overpayment reviews.

The VA’s computers constantly compare records against Social Security Administration databases, IRS filings, and other federal systems. When discrepancies appear, flags get raised and investigations begin.

These automated matches aren’t always accurate. Computer systems can misinterpret data, create false positives, or fail to account for timing differences between agencies. A computer flag doesn’t necessarily mean an actual overpayment exists.

Database timing creates particular problems. Income might appear higher in IRS records due to reporting periods that don’t align with VA benefit years. These timing mismatches can trigger overpayment investigations for situations that don’t actually violate VA rules.

Recent congressional testimony highlights systemic issues with VA processing: “Claims processors at the Department of Veterans Affairs were inadequately trained and unprepared for the influx of veterans seeking benefits under the PACT Act, leading to improper decisions and miscalculated payments” according to The American Legion.

Scheduled Reviews: Periodic Eligibility Checks

Periodic eligibility reviews of pension recipients and dependency claims help identify ongoing eligibility issues, though these reviews may occur months or years after overpayments begin.

The VA conducts periodic reviews of certain benefit types, particularly pension benefits and dependency allowances. These reviews can uncover overpayments that have been occurring for extended periods.

Review timing varies significantly. Some veterans receive reviews annually, others go years without scrutiny. This inconsistency means overpayments can accumulate to substantial amounts before detection.

When reviews finally happen, they often reveal multiple issues simultaneously. A single review might uncover dependency overpayments, income violations, and rating discrepancies all at once, creating complex debt situations.

What the VA Must Tell You: Notification Requirements

When overpayments are identified, the VA must follow specific notification procedures providing veterans with essential information about debt amounts, causes, and available resolution options including appeal rights and waiver possibilities.

The First Letter: Required Content

Initial overpayment notifications must include specific debt amounts, time periods, explanations of how overpayments occurred, and clear information about appeal rights and waiver options.

That first overpayment letter contains crucial information. The VA must include specific details that give veterans the foundation for challenging determinations or requesting relief.

Debt amounts must be clearly stated with breakdowns by time period. When letters only provide totals without explaining calculations, this indicates incomplete notice that can be challenged.

The explanation of how the overpayment occurred is critical. Vague statements like “benefits weren’t entitled” aren’t sufficient. The VA must explain exactly what changed, when it changed, and why it affected benefits.

Veteran Brent Aber from Akron, Ohio, reported his divorce in 2015 to remove his ex-wife as a dependent. Eight years later, he received a letter demanding repayment of over $17,700. The VA claimed different computer systems don’t communicate, meaning his dependent removal was never registered nationally, continuing overpayments for years.

Response Windows: Understanding Deadlines

Veterans typically receive 180 days to request hearings, submit waivers, or arrange payment plans, though these deadlines can be extended under certain circumstances involving good cause or VA processing delays.

The standard 180-day response period isn’t as rigid as it appears. Understanding options for extending deadlines can provide crucial additional time for building responses.

Good cause extensions are available when circumstances beyond control prevented timely response. Medical emergencies, family crises, or even VA processing delays can justify deadline extensions.

The 180-day clock starts when veterans receive notice, not when the VA mails it. When receipt occurred later than the VA assumes, additional response time might be available.

Documentation: What Should Be Provided

Proper VA notifications must include copies of relevant evidence, rating decisions, or supporting documentation that enables veterans to formulate appropriate responses to overpayment determinations.

The VA should include copies of evidence supporting their overpayment determination. Rating decisions, income calculations, or dependency verification documents should accompany initial notices.

Missing documentation weakens the VA’s position and strengthens response options. When income limit violations are claimed but income calculations aren’t provided, the adequacy of notice can be challenged.

Incomplete evidence packages often indicate rushed determinations. When the VA fails to provide supporting documentation, it suggests cases haven’t been thoroughly reviewed—creating opportunities for successful challenges.

Your Options When Facing Overpayment Demands: Resolution Strategies That Work

Veterans facing overpayments have multiple resolution pathways including waiver applications that can eliminate debts entirely and repayment plans that balance VA collection interests with veteran financial stability.

Receiving an overpayment notice doesn’t mean automatic debt obligation. Several powerful options exist for resolving these situations—some of which can eliminate obligations entirely.

Understanding which strategy fits specific situations and how to present cases most effectively is key. Each resolution path has different requirements and potential outcomes that must be carefully evaluated.

Waiver Applications: Opportunities for Debt Elimination

Requesting waiver of overpayment debts often represents the most beneficial resolution option, requiring veterans to demonstrate they were “without fault” in creating overpayments and that collection would cause financial hardship.

Proving “Without Fault”

Veterans must prove they didn’t know or reasonably shouldn’t have known they were receiving incorrect payments, often requiring detailed documentation of their actions and available information.

The “without fault” standard focuses on reasonable behavior based on available information. When veterans relied on VA communications or had no reason to suspect overpayments, they might qualify for complete debt forgiveness.

The complexity of these determinations becomes clear when considering that since fiscal year 2013, the VA has clawed back more than $2.5 billion from about 122,000 disabled veterans who had unintentionally received both benefits according to NBC News reporting.

Documenting reasonable reliance is crucial. When veterans reported changes when they believed they were supposed to, or asked questions when things seemed unclear, these actions demonstrate good faith that supports “without fault” determinations.

VA communication failures often support “without fault” claims. When the VA gave conflicting information, failed to explain reporting requirements clearly, or processed reports incorrectly, these failures can eliminate fault in creating overpayments.

Consider this scenario: a veteran reports marriage to the VA, but they continue paying single-veteran pension rates for six months. When they finally process the report and demand repayment of overpaid amounts, strong grounds exist for a “without fault” determination.

Financial Hardship: Demonstrating Inability to Repay

Even when “without fault” is established, veterans must demonstrate that repayment would deprive them or their families of basic necessities, requiring comprehensive financial disclosure and supporting documentation.

Financial hardship waivers focus on current ability to repay without sacrificing basic needs. This evaluates whether repayment would force impossible choices between debt payment and essential expenses.

Basic necessities include housing, food, medical care, and transportation needed for work or medical appointments. When repaying the overpayment of va benefits would force choices between these essentials and debt payment, hardship relief likely applies.

Income alone doesn’t determine hardship. Veterans with decent income but high medical expenses, mortgage payments, or family obligations might still qualify for hardship waivers if repayment would create genuine financial distress.

Repayment Plans: Making Debt Manageable

When waivers aren’t available or appropriate, veterans can negotiate manageable repayment terms that balance VA collection interests with veteran financial stability and continued benefit eligibility.

Monthly Payment Arrangements

The VA typically allows veterans to establish affordable monthly payment plans based on their financial capacity, often accepting payments as low as $25-50 per month for substantial debts.

The VA generally accepts reasonable payment proposals based on financial capacity. Rather than collecting nothing, they prefer accepting monthly payments, giving veterans significant negotiating power in establishing affordable payment terms.

Payment amounts can be surprisingly low. The VA has accepted $25-50 monthly payments on debts exceeding $10,000. The key is demonstrating that proposed payments represent reasonable portions of available income after essential expenses.

Payment plans don’t accrue interest, making them more manageable than commercial debt. Once payment plans are established and maintained consistently, debt gradually decreases without additional financial penalties.

Army Sergeant First Class Praino, who owes nearly $68,000 after the VA continued payments despite his repeated notifications about re-enlisting, now has about $800 automatically garnished from his monthly paychecks, leaving him with approximately $3,800 monthly to support his family of seven.

Benefit Offset: Predictable Resolution

Veterans may agree to have future benefits reduced by specific amounts until overpayments are satisfied, providing predictable resolution timelines while maintaining some benefit income.

Benefit offsets allow repayment through automatic deductions from future VA payments. This approach provides predictability—knowing exactly when debt will be satisfied and how much income will be available each month.

Offset amounts are negotiable. The VA might propose taking 50% of monthly benefits, but counteroffers with lower percentages that leave sufficient income for living expenses are possible.

Partial offsets often work better than full benefit suspension. Maintaining some monthly income helps meet ongoing expenses while still addressing overpayment debt in reasonable timeframes.

Beware of VA Overpayment Scams: Protecting Yourself from Fraud

Fraudsters are increasingly targeting veterans with sophisticated VA overpayment scams. Understanding how to identify and avoid these scams protects veterans from financial loss and identity theft.

How Scammers Target Veterans

Scammers impersonate official VA representatives using official communication channels to demand repayment for alleged benefits overpayments. Fraudulent letters, emails, and texts often include fake VA letterheads and logos, making it difficult to distinguish genuine VA communications from scams.

Common Scam Tactics

Fake VA Letterheads and Logos: Scammers often use fake VA letterheads, logos, and even spoofed phone numbers to make their communications appear authentic.

Claims of Overpayment: Scammers claim veterans have been overpaid on VA benefits and now owe money back to the VA.

Pressure Tactics: Scammers may pressure veterans into making immediate payments directly to them instead of through official VA payment channels. Requests for payment via wire transfers, bitcoin, prepaid debit cards, money transfers, or gift cards are often signs of scams.

Requests for Sensitive Information: Scammers may ask for sensitive information, such as VA login credentials, passwords, or financial information.

How to Protect Yourself from Overpayment Scams

If communications are received about VA benefits overpayment, logging into the official VA.gov account immediately to verify if money is truly owed is essential. The VA website will provide clear information on whether debts exist. When debts do exist, VA’s Debt Management Center (DMC) offers many repayment options.

Essential Protection Steps

Verify Authenticity: If letters or communications about VA benefits overpayment are received, logging into official VA.gov accounts immediately to verify if money is truly owed is critical.

Only Use Official VA Channels: When debts to the VA exist, resolving them directly using VA.gov or by calling VA’s Debt Management Center (DMC) at 1-800-827-0648 is required.

Never Share Login Information: The VA will never ask for login credentials or passwords.

Be Cautious of Unsolicited Contact: Wariness of unsolicited emails or texts asking for personal details or directing to external websites that aren’t part of VA.gov is essential.

Do Not Pay Upfront Fees: When someone demands upfront payment to help with VA debt or claims, it’s a scam. The VA offers free help with managing debts and claims. VA accredited representatives can be found at www.va.gov/get-help-from-accredited-representative/find-rep/.

Avoid Clicking on Unknown Messages: Caution is needed when emails or texts requesting personal information are received. Scammers often create fake links or attachments to trick recipients into downloading malware or malicious code to steal data. Always review sender information carefully and avoid clicking on links or attachments from unknown sources.

Never Share Sensitive Information: Personally identifying information (PII) and financial information should be secured. Never share sensitive information, such as social security numbers, bank account details, or credit card information when responding to unsolicited requests.

How to Report VA Overpayment Scams

Contact VA: When scams are encountered or fraudulent activity is suspected, contacting the VA immediately at 1-800-827-1000 is important.

File a Complaint: Fraud can also be reported to the Federal Trade Commission (FTC) at reportfraud.ftc.gov.

Veterans who suspect they have experienced fraud can find out more and report to the appropriate agency online at VSAFE.gov or by calling (833) 38V-SAFE.

Preventing Future Overpayment Headaches: Smart Practices Every Veteran Should Know

Proactive strategies help veterans avoid overpayment situations through proper reporting compliance and documentation maintenance, while professional assistance from VSOs and attorneys provides expert guidance for complex overpayment challenges.

Prevention beats resolution every time. Smart practices can help avoid overpayment situations entirely while ensuring veterans receive all benefits earned through service.

The effort invested in prevention pays dividends in avoided stress, financial complications, and time spent resolving overpayment issues that could have been prevented with proper attention to reporting requirements.

Staying Compliant: Reporting Responsibilities

Veterans have ongoing responsibilities to report changes affecting benefit eligibility, and understanding these requirements is essential for preventing overpayments and maintaining benefit continuity.

Timely Change Reporting: When and What to Report

Veterans must promptly notify the VA of marriage, divorce, dependent status changes, income increases, or other circumstances that might affect benefit amounts or eligibility.

Marriage, divorce, and dependency changes require immediate reporting—within 30 days of the change. Waiting until annual reviews or next VA appointments can create months of va benefits overpayment situations that become the veteran’s responsibility to repay.

VA officials emphasize the importance of prompt reporting: “Timely reporting of these changes in beneficiary status significantly impacts VA’s ability to deliver appropriate benefits” according to Nina Tann, executive director for VA’s compensation service.

Income changes for pension recipients need reporting as they occur, not at year-end. Part-time jobs, Social Security increases, or inheritance checks can push recipients over income limits immediately. Prompt reporting prevents overpayments from accumulating.

School enrollment changes for dependent children require attention throughout the academic year. Mid-semester drops, reduced course loads, or graduation all affect dependency payments. Changes should be reported when they happen, not at semester end.

Essential Reporting Checklist:

- Marriage or divorce within 30 days

- Birth or adoption of children immediately

- Dependent children’s school enrollment changes

- Income increases for pension recipients

- Address changes within 30 days

- Death of spouse or dependent immediately

- Military retirement or return to active duty

- Changes in medical expenses (for pension)

Documentation: Maintaining Financial Paper Trails

Keeping detailed records of all VA communications, benefit payments, and personal circumstances helps veterans respond effectively to overpayment allegations and protect their interests.

Maintaining copies of every document sent to the VA and every communication received creates paper trails that become invaluable when overpayment disputes arise and proof is needed of what was reported and when.

Bank statements showing VA deposits help establish payment patterns and amounts. When the VA claims overpayments occurred, bank records provide independent verification of what was actually received.

Dating and documenting every phone call with the VA is essential. Noting who was spoken with, what was discussed, and any instructions or information provided creates records that can support “without fault” claims if VA representatives gave incorrect guidance.

Getting Professional Help: When to Seek Expert Assistance

Given the complexity of overpayment issues, veterans often benefit from professional assistance in navigating resolution processes and protecting their rights throughout overpayment proceedings.

Veterans Service Organizations: Free Expert Help

Accredited VSO representatives can provide free assistance with overpayment appeals, waiver applications, and negotiations, offering expertise in VA procedures and veteran advocacy.

VSO representatives understand VA procedures and can navigate overpayment processes more effectively than most veterans can alone. Their experience with similar cases gives them insight into successful resolution strategies.

Free representation means choices don’t have to be made between getting help and paying bills. VSOs are funded to help veterans, not to generate profit from financial distress.

VSO advocacy extends beyond paperwork. They can communicate with VA personnel on behalf of veterans, attend hearings with them, and ensure rights are protected throughout the overpayment process.

Legal Representation: When Stakes Are High

Complex overpayment cases may require attorney assistance, particularly when substantial amounts are involved or when VA procedures weren’t properly followed during the overpayment process.

Attorney representation becomes valuable when overpayment amounts are substantial or when the VA hasn’t followed proper procedures. Legal expertise can identify procedural violations that might eliminate debts entirely.

Complex cases involving multiple benefit types, lengthy time periods, or disputed facts often benefit from legal analysis. Attorneys can evaluate evidence, identify weaknesses in the VA’s case, and develop comprehensive response strategies.

Due process violations by the VA can result in debt cancellation regardless of whether overpayments actually occurred. Attorneys are trained to spot these procedural failures that veterans might miss.

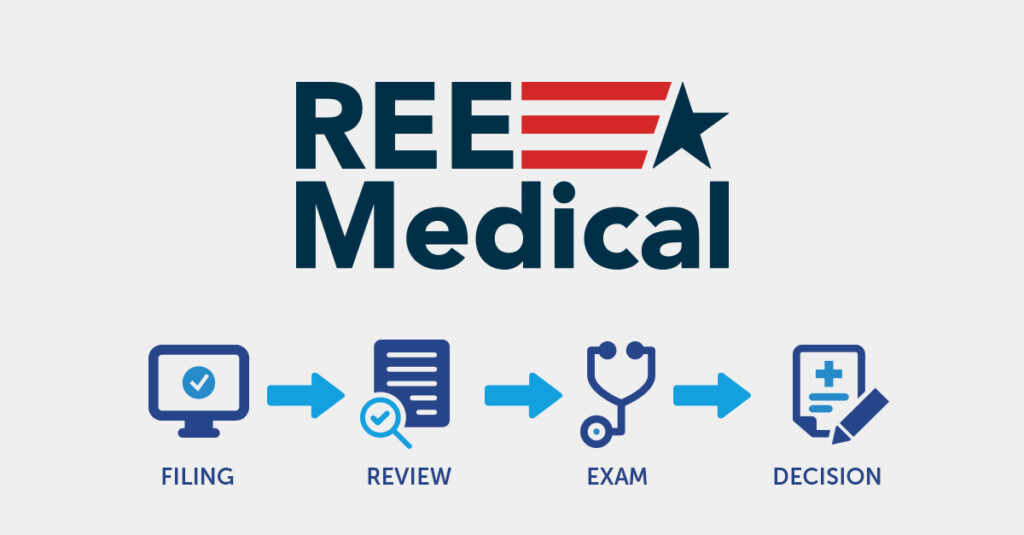

How REE Medical Supports Accurate Benefit Determinations

Accurate medical evidence can help reduce the risk of overpayment situations developing in the first place. When disability ratings are evaluated using comprehensive medical documentation, veterans may face fewer overpayment issues that stem from incorrect ratings or incomplete medical evidence.

REE Medical coordinates independent medical evaluations and Disability Benefits Questionnaires (DBQs) prepared by licensed medical professionals. These evaluations create detailed records that support the VA’s evaluation of current disability levels. When the VA reviews disability levels, comprehensive medical evidence from experienced physicians provides clear, detailed information for the VA to consider.

During overpayment challenges, financial stability allows focus on resolution rather than worrying about additional expenses. REE Medical’s transparent, flat-fee approach is structured so veterans can obtain necessary medical evidence with clear, upfront costs during already difficult periods.

Ready to help ensure disability ratings are supported by comprehensive medical documentation? Contact REE Medical to learn more about coordinating independent, VA-compliant medical evaluations that support accurate benefit determinations.

Final Thoughts

VA benefits overpayments represent serious financial challenges that require immediate attention and strategic response, but veterans have significant rights and options for resolution including debt elimination through waivers, manageable repayment plans, and strong procedural protections.

VA benefits overpayments create serious financial challenges that can impact family stability and future benefit security. But veterans aren’t powerless in these situations.

Legal rights are real and enforceable. The VA must follow specific procedures, provide proper notice, and respect due process rights. When they don’t, grounds exist to challenge actions and potentially eliminate debts entirely.

Waiver applications offer genuine opportunities for debt forgiveness. Many veterans qualify for “without fault” determinations or financial hardship relief but never request these options because they don’t know they exist.

Professional help is available and often free through VSOs. Complex overpayment situations shouldn’t be navigated alone when experienced advocates are ready to help protect interests.

Prevention remains the best strategy. Prompt reporting of life changes, careful documentation, and proactive communication with the VA can prevent most overpayment situations from developing.

Remember: receiving an overpayment notice isn’t the end—it’s the beginning of a process where rights, options, and often paths to complete debt elimination exist. Taking action quickly, understanding options thoroughly, and seeking professional assistance when facing substantial overpayments or complex situations is essential.

Stay vigilant against overpayment scams. Always verify communications through official VA.gov channels and never share sensitive information or make payments to anyone claiming to represent the VA outside official channels.

Disclosure

DISCLAIMER: REE Medical, LLC is not a Veterans Service Organization (VSO) or a law firm and is not affiliated with the U.S. Veterans Administration (“VA”). Results are not guaranteed, and REE Medical, LLC makes no promises. REE Medical’s staff does not provide medical advice or legal advice, and REE Medical is not a law firm. Any information discussed, such as, but not limited to, the likely chance of an increase or service connection, estimated benefit amounts, and potential new ratings, is solely based on past client generalizations and not specific to any one patient. The doctor has the right to reject and/or refuse to complete a Veteran’s Disability Benefit Questionnaire if they feel the Veteran is not being truthful. The Veteran’s Administration is the only agency that can make a determination regarding whether or not a Veteran will receive an increase in their service-connected disabilities or make a decision on whether or not a disability will be considered service-connected. This business is not sponsored by, or affiliated with, the United States Department of Veterans Affairs, any State Department of Military and Veterans Affairs, or any other federally chartered veterans service organization.