VA Disability Compensation Rates: The Hidden Money You’re Missing Out On

The VA disability compensation system affects millions of veterans, with monthly payments ranging from $180.42 for a 10% rating to $3,938.58 for a 100% rating in 2026 after a 2.8% cost-of-living adjustment. Understanding how these numbers shift from year to year—and how the VA calculates them—can help veterans interpret the rate tables and understand how monthly payments are determined.

Veterans reviewing the VA disability compensation rate tables often find that thorough, accurate medical documentation is an important part of the VA’s evidence-based evaluation process. This comprehensive guide explains how the VA evaluates conditions, what current compensation amounts look like, and how independent medical documentation can support a clear, VA-compliant clinical record for VA review.

TL;DR

- VA disability compensation uses a 0-100% rating scale with specific monthly dollar amounts that increase significantly at higher percentages

- Veterans with dependents receive additional monthly compensation on top of their base disability rating

- Special Monthly Compensation (SMC) provides extra payments for severe disabilities, loss of limbs, or need for aid and attendance

- Compensation rates adjust annually for cost-of-living increases, typically effective December 1st

- Multiple disabilities combine using VA math (not simple addition) to determine overall rating

- Individual Unemployability (TDIU) may allow payment at the 100% rate for some veterans who meet VA criteria, even if the combined rating is below 100%.

- Thorough medical documentation helps the VA evaluate a condition’s diagnosis, symptoms, and functional impact based on the evidence in the record.

- Secondary conditions may affect the overall evaluation when they’re clinically documented and, where appropriate, addressed in the VA’s review.

Understanding the VA Disability Rating System That Determines Monthly Compensation

The VA disability compensation system operates on a percentage-based structure from 0% to 100%, where each rating level corresponds to specific monthly dollar amounts. The VA determines compensation through a combination of the disability percentage, dependent status, and special circumstances, with payments processed monthly and updated annually for cost-of-living adjustments.

The foundation of VA disability compensation rests on a straightforward concept: percentages that translate into real money each month. However, what many veterans don’t realize is that the difference between rating levels can mean thousands of dollars annually.

A disability rating represents the VA’s way of quantifying how service-connected conditions impact the ability to work and live normally. The system uses incremental steps (10%, 20%, 30%, and so on) rather than allowing for ratings like 15% or 25%. Understanding VA disability compensation rates becomes crucial when recognizing that even small increases in rating percentage can result in substantial monthly payment increases that compound over decades.

How Ratings Translate Into Monthly Benefits

Each disability percentage corresponds to a specific monthly compensation amount, with total payments calculated by combining the base rating, dependent allowances, and any special compensation eligibility. The system accounts for Individual Unemployability status, which can provide 100% compensation even when the combined rating falls below that threshold.

The jump between rating levels becomes more dramatic as percentages increase. A veteran with a 60% rating receives significantly more than someone at 50%—and the gap widens even further at higher levels.

When veterans have dependents, the VA adds extra compensation to the base amount. This includes spouses, children under 18 (or under 23 if in school), and dependent parents. The additional amounts vary based on disability percentage, with higher-rated veterans receiving more substantial dependent benefits. Veterans seeking to understand their current compensation levels can explore what a 100% VA disability rating provides to grasp the full scope of benefits available at the highest rating level.

Example: Consider two veterans: John has a 50% disability rating and receives $1,132.90 monthly as a single veteran. Sarah also has a 50% rating but has a spouse and two children, receiving additional compensation that brings her total monthly payment to $1,269.90—an extra $137 monthly, or $1,644 annually, based on dependent status.

The Math Behind Combined Ratings

When veterans have multiple disabilities, the VA uses a specific mathematical formula rather than simple addition to determine the overall combined disability rating. This “VA math” system prevents combined ratings from exceeding 100% and often results in lower overall percentages than veterans might expect from adding individual ratings together.

Multiple service-connected conditions don’t simply add up the way one might expect. If a veteran has a 30% rating for the back and a 20% rating for tinnitus, the combined rating isn’t 50%. The VA uses what’s commonly called “VA math”—a formula that considers remaining capacity for disability.

The highest-rated condition establishes the baseline. Each additional condition is then applied to the remaining “whole person” capacity. This system ensures no veteran can exceed 100% disability, but it often means the combined rating falls short of what simple addition would suggest. Veterans can use the VA disability calculator to estimate how multiple conditions may combine.

VA Combined Rating Examples:

| First Disability | Second Disability | Combined Rating | Rounded Rating |

| 40% | 20% | 52% | 50% |

| 60% | 30% | 72% | 70% |

| 70% | 40% | 82% | 80% |

| 50% | 30% | 65% | 70% |

| 80% | 20% | 84% | 80% |

Individual Unemployability (TDIU): When VA May Pay at the 100% Rate

Individual Unemployability (IU) allows veterans who cannot maintain substantially gainful employment due to service-connected disabilities to receive compensation at the 100% rate, even when their combined rating is less than 100%. This provision recognizes that disability impact on employment capacity may exceed what standard ratings reflect.

Sometimes disabilities prevent working even when the combined rating doesn’t reach 100%. That’s where Individual Unemployability comes in. If a veteran can’t maintain substantially gainful employment due to service-connected conditions, the VA may determine that TDIU criteria are met and pay at the 100% rate.

Per VA guidance, the criteria are specific: typically at least one condition rated 60% or higher, or multiple conditions with one at 40% and a combined rating of 70% or more. Meeting percentage thresholds is one factor; the VA also reviews evidence about functional limitations and work capacity as part of its decision.

IU Eligibility Considerations (per VA guidance):

- One disability rated 60% or higher, OR

- Multiple disabilities with one at 40% and combined rating of 70%+

- Unable to maintain substantially gainful employment

- Employment limitations directly caused by service-connected disabilities

- Medical evidence supporting unemployability

- Complete employment history documentation

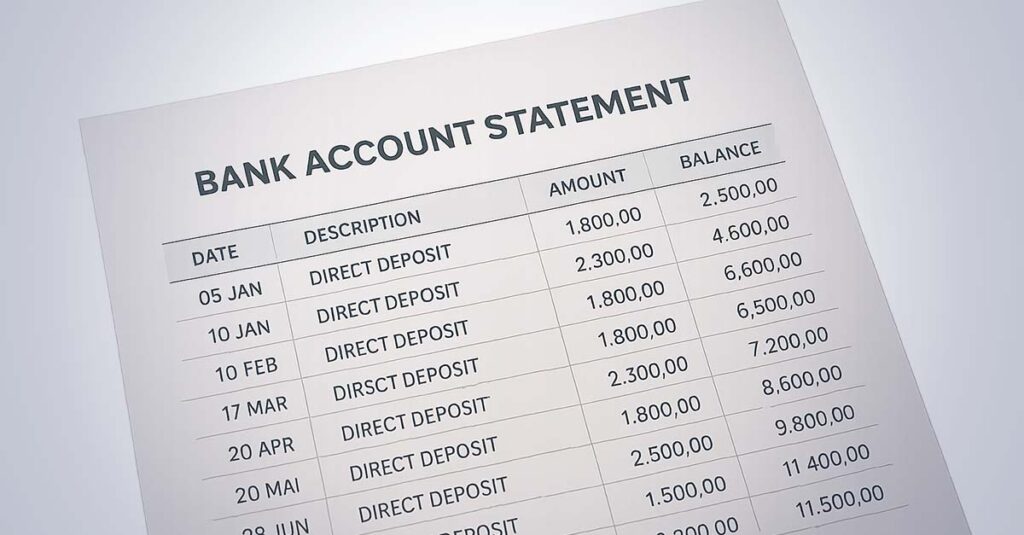

Payment Processing and What to Expect

The VA processes disability compensation through direct deposit or check distribution, with payments typically made on the first business day of each month. The system includes specific procedures for addressing payment issues and ensures veterans receive their compensation reliably and on schedule.

Payment amounts reflect current rating, dependent status, and any special circumstances. When changes occur (like adding a dependent or receiving a rating increase), the VA adjusts payments accordingly, often including retroactive amounts for the period between the effective date and when the change was processed.

Current Compensation Rates and How They Impact Financial Planning

VA disability compensation rates are established annually with specific dollar values for each rating percentage, varying based on the number of dependents and special circumstances. These rates undergo annual cost-of-living adjustments and follow standardized payment schedules that veterans can rely on for financial planning purposes.

The dollars and cents behind disability ratings tell a story of significant financial impact. Current compensation rates reveal substantial differences between rating levels, especially as percentages climb higher.

Understanding these rate structures helps veterans grasp the real-world implications of rating decisions. A 10% increase in rating doesn’t just mean a 10% increase in compensation—the jumps between levels often represent much larger percentage increases in actual dollars. For the most current information on payment amounts, veterans can review the latest 2025 VA disability compensation rates to ensure they’re receiving the correct monthly amounts based on updated calculations.

Recent Update: The 2026 rates reflect a 2.8% cost-of-living adjustment. According to the U.S. Department of Veterans Affairs, a 100% rating increases from $3,831.30 to $3,938.58, representing meaningful monthly increases across all rating levels.

Breaking Down the Standard Rating Scale

The VA uses incremental rating percentages (10%, 20%, 30%, 40%, 50%, 60%, 70%, 80%, 90%, 100%) with corresponding compensation amounts that increase substantially at higher disability levels. The financial gap between rating levels becomes more pronounced as percentages increase, making higher ratings significantly more valuable.

Each rating level represents a specific monthly amount, but the increases aren’t proportional. The difference between 90% and 100% disability compensation is substantial—often more than the entire compensation amount for lower ratings.

This structure reflects the VA’s recognition that higher levels of disability create exponentially greater impacts on life and earning capacity. A 100% disabled veteran faces challenges that go far beyond what someone with a 30% rating experiences.

The rating scale also includes a 0% rating, which provides no monthly compensation but establishes service connection for the condition. This can be valuable for future increases if the condition worsens, and it may qualify veterans for VA healthcare for that specific condition.

The new VA disability compensation rates for 2026 demonstrate the VA’s commitment to ensuring benefits keep pace with cost-of-living increases, providing veterans with meaningful adjustments that protect their purchasing power over time.

2026 VA Disability Compensation Rates (Single Veteran):

| Disability Rating | 2026 Monthly Rate (Single) | Annual Amount | Increase from Previous Level |

| 10% | $180.42 | $2,165.04 | Base Level |

| 20% | $356.66 | $4,279.92 | $176.24 |

| 30% | $552.47 | $6,629.64 | $195.81 |

| 40% | $795.84 | $9,550.08 | $243.37 |

| 50% | $1,132.90 | $13,594.80 | $337.06 |

| 60% | $1,435.02 | $17,220.24 | $302.12 |

| 70% | $1,808.45 | $21,701.40 | $373.43 |

| 80% | $2,102.15 | $25,225.80 | $293.70 |

| 90% | $2,362.30 | $28,347.60 | $260.15 |

| 100% | $3,938.58 | $47,262.96 | $1,576.28 |

How Dependents Affect Monthly Compensation

Veterans with dependents receive additional monthly compensation on top of their base disability rating amount, with dependent allowances varying based on the veteran’s disability percentage and the type of dependent (spouse, children, or dependent parents). Higher-rated veterans receive more substantial dependent benefits.

Family size directly impacts compensation amount. The VA provides additional monthly payments for spouses, children, and dependent parents, recognizing that disabilities affect not just the veteran but their entire household.

Dependent rates aren’t flat amounts—they scale with disability rating. A veteran with a 30% rating receives less additional compensation for dependents than someone rated at 70%. This scaling acknowledges that higher levels of disability create greater family impacts and care needs.

Example: A veteran with a 70% rating and one child receives $1,858.19 monthly, compared to $1,808.45 for a single veteran at the same rating level. That additional $49.74 monthly for one child equals $596.88 annually—meaningful support that recognizes the extra costs of raising a family while managing significant disabilities.

Special Monthly Compensation: The Extra Benefits Most Veterans Don’t Know About

Special Monthly Compensation (SMC) provides additional compensation beyond standard disability ratings for veterans with severe disabilities, loss of use of organs or extremities, or those requiring aid and attendance. These benefits represent some of the highest compensation levels available and address specific severe impairments that standard ratings don’t adequately cover.

Beyond standard disability ratings lies a compensation tier that many veterans never discover: Special Monthly Compensation. SMC addresses severe disabilities that standard ratings can’t adequately capture, often providing substantial additional monthly payments.

These aren’t small adjustments to regular compensation—SMC can add hundreds or even thousands of dollars to a monthly check. Yet many eligible veterans miss out because they don’t understand the criteria or realize they qualify.

The SMC system recognizes that certain disabilities create impacts far beyond what percentage ratings can measure. Loss of limbs, blindness, need for aid and attendance, and other severe impairments receive additional compensation that reflects their profound life impact.

Loss of Use and Anatomical Loss Benefits

Veterans who experience loss of use or anatomical loss of specific body parts, organs, or bodily functions receive SMC payments in addition to their regular disability compensation. These benefits recognize that certain severe impairments create impacts beyond what standard percentage ratings can address.

Losing the use of a hand, foot, or other body part can trigger SMC eligibility, even if the physical limb is still present. “Loss of use” means the body part has no functional value—it’s essentially the same as if it were amputated.

The compensation reflects the profound impact these losses have on daily life. Whether someone has lost vision in both eyes, use of both arms, or reproductive function, SMC provides additional monthly compensation that recognizes these specific severe impairments.

Understanding SMC-K Through SMC-S Classifications

SMC classifications from K through S cover various levels of severe disabilities, ranging from loss of use of one foot or hand (SMC-K) to the highest levels requiring aid and attendance with additional complications (SMC-S). Each classification corresponds to specific compensation amounts that supplement regular disability payments.

The SMC system uses letter designations that correspond to different levels of severe disability. SMC-K covers loss of use of one foot or hand, while higher classifications address multiple losses or more severe impairments.

SMC Classification Quick Reference:

- SMC-K: Loss of use of one foot or hand

- SMC-L: Loss of use of both feet, both hands, or one of each

- SMC-M: Multiple severe losses or blindness with other losses

- SMC-N: Aid and Attendance required

- SMC-O: Aid and Attendance with additional severe disabilities

- SMC-R: Aid and Attendance with specific combinations

- SMC-S: Highest level – Aid and Attendance with multiple severe conditions

Aid and Attendance: When Help Is Needed With Daily Life

Veterans who require the regular aid and attendance of another person for basic daily living activities qualify for additional monthly compensation to cover care costs. This benefit recognizes that some disabilities create care needs that go beyond what standard ratings address.

When disabilities require another person’s help with basic daily activities, Aid and Attendance benefits can provide substantial additional compensation. This isn’t about occasional assistance—it’s for veterans who need regular help with fundamental tasks like bathing, dressing, or eating.

Qualifying Conditions and Documentation Requirements

Specific medical conditions and functional limitations must be documented to establish aid and attendance eligibility, including inability to perform basic self-care tasks. The VA requires comprehensive medical evidence that clearly demonstrates the need for regular assistance with daily living activities.

Per VA guidance, qualifying for Aid and Attendance requires clear medical evidence of the need for assistance. The VA looks for documentation showing inability to perform basic self-care tasks without help, being bedridden, or having severe mental impairments requiring supervision.

Housebound Benefits: The Middle Ground

Veterans who are substantially confined to their homes due to service-connected disabilities may qualify for housebound benefits, which provide compensation between standard ratings and full aid and attendance levels. This benefit addresses situations where veterans face significant mobility limitations without requiring full-time care.

Housebound benefits fill the gap between standard compensation and full Aid and Attendance. If a veteran is substantially confined to their home because of service-connected disabilities, but doesn’t need constant personal care, Housebound benefits might apply.

Annual Rate Updates and What They Mean for Future Payments

VA disability compensation rates undergo annual adjustments based on cost-of-living increases, with changes typically taking effect December 1st and reflected in payments beginning the following month. These updates follow federal guidelines to ensure disability compensation maintains purchasing power and keeps pace with inflation.

Disability compensation doesn’t stay frozen in time. Each year, the VA adjusts rates to account for cost-of-living changes, ensuring benefits maintain their purchasing power as prices rise.

These annual increases might seem small in percentage terms, but they add up over time. For veterans receiving substantial monthly compensation, even modest percentage increases translate into meaningful additional dollars each month.

Understanding how VA disability compensation rates evolve annually helps veterans plan for long-term financial stability and anticipate how their benefits will grow over time.

The Cost-of-Living Adjustment Process

The VA follows federal guidelines to implement annual cost-of-living adjustments (COLA) that ensure disability compensation keeps pace with inflation and maintains purchasing power for veterans. This process involves analyzing economic indicators and applying standardized adjustment formulas across all compensation rates.

The COLA process follows established federal procedures, typically mirroring Social Security adjustments. The VA doesn’t arbitrarily decide on increases—they’re based on economic data measuring inflation and cost changes.

These adjustments apply automatically to all veterans receiving compensation. No paperwork or action is needed—the increases appear in payments once they take effect.

Historical Trends and Future Planning

Understanding how rates have changed over time helps veterans anticipate future adjustments and plan for long-term financial needs. Historical rate progression analysis reveals patterns in compensation growth that can inform veterans’ financial planning decisions.

Looking at historical rate increases reveals patterns useful for financial planning. While exact future increases can’t be predicted, understanding typical adjustment ranges helps with long-term planning.

Implementation Timeline for New Rates

New rates are announced in advance of their effective date, with the VA updating systems and notifying veterans of changes to their monthly compensation amounts. The implementation process follows a predictable timeline that veterans can rely on for financial planning purposes.

The VA announces new rates before they take effect, usually in late fall for December implementation. This advance notice helps veterans understand what their new payment amounts will be.

Legislative Changes Beyond COLA

Congressional action can modify disability compensation rates, eligibility criteria, or benefit structures beyond standard COLA adjustments, requiring veterans to stay informed about potential changes. Legislative impacts can create significant changes to compensation structure that go beyond routine annual adjustments.

Sometimes Congress makes changes that go beyond routine cost-of-living adjustments. New legislation can modify benefit structures, create new compensation categories, or change eligibility criteria in ways that significantly impact veterans.

The Role of Strong Medical Documentation in VA Evaluations

Thorough medical documentation allows the VA to accurately evaluate conditions and assign appropriate ratings. Comprehensive medical evidence forms the foundation for accurate VA assessments, requiring documentation that clearly establishes the severity and impact of service-connected conditions.

Medical records tell the story of disabilities and their impact on life. Comprehensive documentation doesn’t just support current evaluations—it creates a foundation for future assessments if conditions worsen.

Effective medical documentation goes beyond basic treatment records. It includes detailed descriptions of symptoms, functional limitations, and how conditions affect daily activities and work capacity. Veterans can learn more about the importance of medical evidence in VA disability evaluations to understand how comprehensive records support accurate assessments.

About Compensation and Pension Examinations

The VA may schedule a Compensation and Pension (C&P) examination to review conditions as part of their evaluation process. These examinations are critical components of the rating process, providing crucial medical evidence that directly influences rating decisions and compensation amounts.

C&P exams often influence rating outcomes. These aren’t routine medical appointments—they’re evaluations specifically designed to assess disability level for compensation purposes.

Independent medical evaluations and DBQs can provide additional clinical documentation for the VA to consider alongside other evidence in the record. This allows the VA to clearly understand diagnosis, symptoms, and treatment history. Thorough documentation can reduce confusion by clearly describing diagnosis, symptoms, functional impact, and relevant history.

Secondary Conditions and Their Impact on Overall Compensation

Many veterans have secondary conditions caused by their rated disabilities, which can significantly increase overall compensation when properly documented. Secondary conditions require medical evidence showing they were caused or aggravated by already service-connected disabilities.

Service-connected disabilities often cause additional problems that qualify as secondary conditions. These aren’t just complications—they’re separate disabilities that may receive their own ratings and compensation.

Secondary conditions can affect the overall evaluation when they’re clinically supported and reviewed by the VA. A veteran with a 30% back rating might develop depression, sleep disorders, or other conditions directly caused by chronic pain. Each secondary condition can add to the combined rating and monthly compensation.

Common Secondary Condition Patterns

Certain primary disabilities frequently lead to predictable secondary conditions. Understanding these common patterns helps veterans identify potential secondary conditions they might otherwise overlook.

Orthopedic injuries often create predictable secondary conditions. Back problems frequently lead to hip, knee, or ankle issues as the body compensates for pain and limited mobility. These aren’t just related problems—they’re separate disabilities caused by the service-connected condition.

Mental health conditions commonly develop secondary to physical disabilities. Chronic pain, mobility limitations, and other physical problems can lead to depression, anxiety, or sleep disorders that may qualify for separate ratings.

Example: Consider a veteran with a 30% back rating who initially had occasional pain and stiffness. Over time, the condition progresses to daily pain requiring prescription medication, limited range of motion, and difficulty with prolonged sitting or standing. These documented changes might support consideration of a higher rating, which may affect how the VA evaluates severity over time—based on the medical evidence and the VA’s review.

How REE Medical Supports Documentation Needs

REE Medical connects veterans with independent, licensed medical providers who can complete disability-focused medical evaluations and VA-standardized forms (such as DBQs), when appropriate. Their specialized approach focuses on comprehensive medical documentation through Disability Benefit Questionnaires (DBQs) while maintaining strict compliance with federal regulations.

Strong medical documentation forms the backbone of accurate VA evaluations, but finding providers who understand VA rating criteria can be challenging. REE Medical helps veterans access independent medical professionals experienced in disability-focused evaluations.

Their approach focuses on comprehensive documentation that accurately reflects disability status. Whether veterans are seeking initial documentation or updated evaluations, having thorough medical evidence that clearly addresses VA rating criteria can significantly impact how the VA assesses conditions.

REE Medical’s nationwide network ensures veterans can access qualified providers regardless of location. Their transparent, flat-rate pricing eliminates surprises while ensuring veterans receive thorough medical documentation. Veterans seeking to understand the documentation process can learn more about DBQs for VA benefits to see how medical evaluations support VA assessments.

REE Medical coordinates access to independent, licensed healthcare professionals who complete DBQs and medical evaluations. Providers are familiar with disability-focused documentation and VA-standardized forms. The company operates within strict compliance frameworks (38 U.S.C. §§ 5901–5905), maintaining neutrality and transparency while adhering to federal regulations.

Important: REE Medical does not prepare, present, or submit VA disability claims and does not provide legal or representational services.

Final Thoughts

VA disability compensation represents significant monthly income that can total hundreds of thousands of dollars over a veteran’s lifetime, making proper understanding crucial. The system’s complexity requires veterans to stay informed about rating structures, special compensation categories, and documentation requirements while taking advantage of annual rate increases.

VA disability compensation represents more than monthly payments—it’s recognition of service and sacrifice, translated into financial support that can span decades. Understanding the system’s intricacies helps ensure veterans receive appropriate compensation based on their documented conditions.

The compensation structure rewards thorough documentation and accurate medical evidence. Veterans who understand rating criteria, maintain strong medical documentation, and have their conditions accurately reflected in their records receive evaluations that reflect their actual disability levels.

Annual rate increases compound over time, making accurate ratings increasingly valuable as years pass. A rating that accurately reflects disability level today impacts every future payment and cost-of-living adjustment.

Veterans looking to understand factors that lead to higher compensation levels can explore what increases a disability rating for additional information. Veterans can also learn more about challenging VA ratings to understand the review process and options available when conditions worsen.

Staying engaged with medical conditions and maintaining regular medical care creates the documentation trail needed to accurately reflect disability status over time. The VA disability compensation system exists to support veterans — understanding how the VA calculates payments can help veterans better interpret their monthly compensation and rate changes over time.

DISCLAIMER: REE Medical, LLC is not a Veterans Service Organization (VSO) or a law firm and is not affiliated with the U.S. Veterans Administration (“VA”). Results are not guaranteed, and REE Medical, LLC makes no promises. REE Medical’s staff does not provide medical advice or legal advice, and REE Medical is not a law firm. Any information discussed, such as, but not limited to, the likely chance of an increase or service connection, estimated benefit amounts, and potential new ratings, is solely based on past client generalizations and not specific to any one patient. The doctor has the right to reject and/or refuse to complete a Veteran’s Disability Benefit Questionnaire if they feel the Veteran is not being truthful. The Veteran’s Administration is the only agency that can make a determination regarding whether or not a Veteran will receive an increase in their service-connected disabilities or make a decision on whether or not a disability will be considered service-connected. This business is not sponsored by, or affiliated with, the United States Department of Veterans Affairs, any State Department of Military and Veterans Affairs, or any other federally chartered veterans service organization.